Views: 16

Having the best car insurance

As mentioned in one of my previous posts, we have gotten into a car accident this past weekend and have thankfully survived unharmed. Because we have the best car insurance we had nothing to worry about, or so we thought.

After we contacted our insurance company we were assigned a insurance agent, together with a case number. Our insurance company contacted us early Monday morning since the accident happened on a weekend. In this initial phone interview we went through the accident again with the insurance company.

It took another day for the claim professional to get in contact with us and to declare that the car is considered a total loss. The email that followed had three attachments in PDF format.

The estimate

The first was a a copy of the estimate, which declares the car a total loss claim. The appraiser of our insurance company created this estimate which listed the expected replacement costs for repairs. Notably the cost to replace the air bags alone was in excess of $4700,-. The body work was only quoted with around $1200,- for parts. The labor cost was not estimated at this point.

Market Valuation Report

In our case the market valuation report was done by CCC ONE, which interestingly has gotten into trouble earlier this year in Massachusetts for low-balling offers according to this article :

“The Massachusetts Division of Insurance has agreed to investigate an allegation that faulty car appraisals by a widely used firm routinely cost drivers hundreds or even thousands of dollars in claims on totaled or stolen vehicles.” and “A complaint filed in August by Source One Financial Corp., a Norwell auto lender, alleges that CCC appraisals often understate car values through sloppiness or fraud, resulting in lowball payouts by insurers.”

Going over the market valuation report, I could see that the interior was a mess and the leather seats were below standard, which quite honestly is true. That is the nature of having a car during the toddler and the early childhood years of your kids.

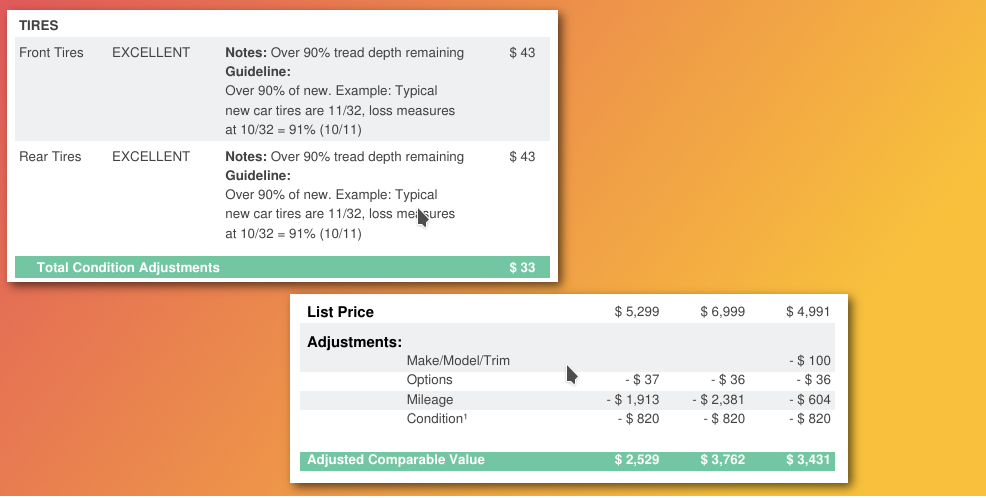

I found some interesting numbers with regard to the condition adjustments however where our overall adjustments were +$33,-. This is mostly due to the set of four completely new tires. But then at the final adjustment the condition for the comparable was set at -$820,-. To the untrained eye this surely looks like a fudge number to adjust the value down.

I asked the Claim Professional from our insurance company about it, here is what he told me: “The Condition1 adjustment makes the adjustment for the difference between what the dealer asking price is and actual sale price for a private owner sale. Most folks do not pay “sticker price” for a vehicle purchase. The actual sale price is usually negotiated.“. So yes, the insurance company is using a fudge number of between negative 15% to 20% to decrease your price.

Unconfusion

After a lot of back and forth to explain this number better the answer was revised to mean that the cars being sold have in general “Above average” condition of the individual components, like tires, carpet, etc. So the calculation goes that in order to get the ready-to-buy car you deduct the above average condition of the individual components down to “Average Condition“.

Again this number to me does not make sense. To replace a car, you have to buy a car. If you buy a car you likely get to chose between whats available. To split out the condition of cars-on-sale is to ignore the fact that you can’t ask to get a car with –average– conditioned parts. And even if it were in average condition, the insurance company would still deduct the pro-forma $820,- (Aka fudge) number. Also with old cars, you will often find them in average or less-than-average condition. Like the tires or carpets have wear.

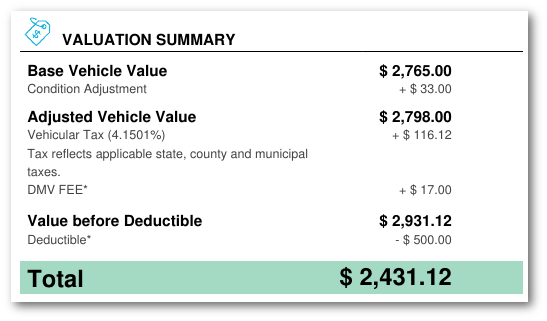

Next on the list of things I did find odd was that the comparable value of our 12 year old Minivan came down to $3240. The total valuation for the car however came in at only $2431,-. That is yet another $810,- less than with the comparable. I also asked about this and it was simply a matter of adding all 12 comparable values together instead of the 3 main ones.

Your Deductible and Claim Payment calculation

- First, we calculate the value of your loss.

- Next, we subtract your deductible.

- Last, we’ll issue your payment.

Following this order you can clearly see what’s last for the insurance company. And as businesses go this may be what makes sense for them because they can. It leaves a bitter taste if your own insurance company takes all the chips off the table. Good business is meant to be beneficial for both parties. Kind of like having a big brother looking out for you when the things go hay wire.

The Power Of Attorney

That was the third attachment to the initial email we received. The power of attorney is required so that our insurance company can take over ownership of the vehicle. You are basically handing your property over to the insurance company without legally selling it to them. They can use this power to do what is needed with the car. In most cases the first thing the insurance company will do is to send someone to the parking-lot where the car was towed and move it to one of their own lots. The towing companies fees of having your damaged car rest on their property can be steep. In our case it was above $100,- per day.

The power of attorney will allow the insurance company to actually move the car off the lot.

Long time since

It has now been two weeks since the accident. We were told by our insurance company that our car rental benefit will run out after two weeks. This was different to the initially mentioned 30 days. You have to make sure to ask if there is any difference for this benefit if your car is being repaired or if your car was totaled. while your car is repaired you may have the rental car longer than to find a replacement car. We have not yet received the reimbursement from the insurance company yet. So we had to make a decision if we want to buy a new ( used ) car now. Otherwise we would have to hold on to the rental a bit longer.

All in all we went ahead and we looked at 5 different cars. We really liked two of them and will most likely buy one of them by the end of this week.

Update: Yes, we finally replaced our family minivan and no we have not yet been reimbursed.

Handling the financial burden

Going to a car dealer and buying a car can be a challenging experience task. Not only do you have to decide on the vehicle you want to buy, you have to also decide how to pay for it. You can either finance the deal through a third party lender, your bank, or in some cases through the car dealership itself. There is no right or wrong way to get about doing this.

In our case we used our bank to apply for a HELOC to pay for the car. This way we received a very favorable 4.0% interest rate on the loan rather then the 4.7% offered otherwise as car loans. You can find a good comparison tool here.

We wanted to pay down the car within 3 years and used the following loan calculator to find that we had to pay at least $590,- per month to get to our goal.

Looking for the best car insurance

After this experience I am ready to move on. I have started to contact 5 different insurance companies for quotes. Although I am in no hurry, I will look around for better things. It maybe that this is the way all insurance companies work or it may be that we will find a better one. At least now we know what we can expect to get from our current insurance company, and we are not pleased.

What did you do ?

Please share your experience with car insurance companies if you have ever had to use one of them.